Pensionskasse

As the largest Austrian pension fund, VBV-Pensionskasse AG organizes the investment of capital and provides services for more than 300,000 employees and pensioners in Austria.

The following video gives a short overview of the pension fund system, contracts and contributions:

Your VBV pension plan

The CPV/CAP Pensionskasse, the pension fund for the Swiss retail and wholesale company Coop-Gruppe, is looking for venture capital investments in start-ups developing solutions linked to environmental issues through innovative technologies. It is also looking at the social aspect of investments.

Um Videos / Maps abspielen / anzeigen zu können, akzeptieren Sie bitte die erforderlichen Cookies.

Pensionskasse Bern

Welcome to the Novartis Pension Funds' website. Here you can find information, the latest news and downloads pertaining to the Novartis pension plans in Switzerland. Pensionskasse der Siemens-Gesellschaften in der Schweiz. Pension Fund Name. CPK Swatch Group. Articles: 1-10 / 17 Page of 2 Pictet LPP 2000 Swiss Pension Fund Indices 2020 YTD Returns. VBV-Pensionskasse AG is such a multi-employer pension fund. Together with its competitors is has become the preferred means for employers to secure occupational retirement for their employees as they offer (in the long run) higher returns, more transparency and more rights regarding the investment of the funds than other products in this sector.

The Austrian pension system

In Austria, as in most other European countries, retirement provisions rest on the so-called “three pillar model”.

The first pillar: state pension plan

The state pension plan is the most important one. The involvement of all gainfully employed people is obligatory. The working population is financing the generation of pensioners. Therefore, it is important that there are enough (or significantly more) employed people in proportion to the number of retired people. The state scheme ensures a good basic provision in old age.

The second pillar: occupational or collective pension plan

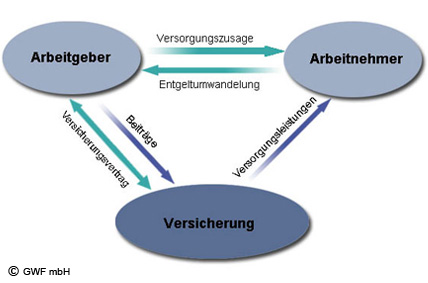

The occupational or collective pension plan is financed by the employer and supported by the state.

The third pillar: private or individual pension plan

The private or individual pension plan is adapted to specific individual requirements (such as savings, life insurance, share funds etc.).

Pension funds are preferred partners for company pensions

One way to provide employees with an occupational retirement provision is via pension funds which by law have to be joint stock companies. There exist single- and multi-employer pension funds. The latter are not limited to a certain company and offer their services to any interested employer.

VBV-Pensionskasse AG is such a multi-employer pension fund. Together with its competitors is has become the preferred means for employers to secure occupational retirement for their employees as they offer (in the long run) higher returns, more transparency and more rights regarding the investment of the funds than other products in this sector.

Additional information about the Austrian pension system is offered here: Federal ministry of labour, social affairs and consumer protection

Downloads for employees

Pensionskasse Post

- Application form for reimbursement of income tax PDF 51 KB

- Employee’s contributions PDF 709 KB

- Notes to the statement regarding development of contributions PDF 1,010 KB

- Life cycle pension plan automatic PDF 2 MB

- Life cycle pension plan classic PDF 2 MB

- Pensionskasse in questions and answers PDF 1 MB

- Online service My VBV/Meine VBV PDF 8 MB

Downloads for pensioners

Pensionskasse Sbb

- Confirmation of being alive PDF 97 KB

- General information for pensioners PDF 762 KB