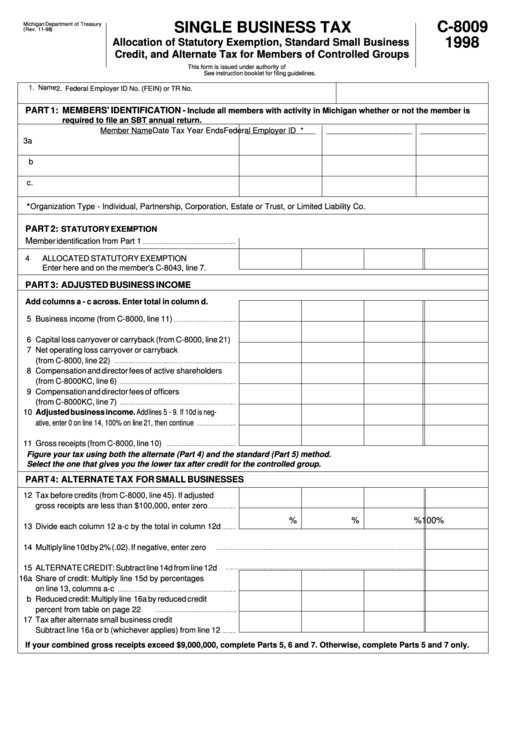

A4 Single Tax Exemption

Tax Bulletin ST-240 (TB-ST-240)

Jan 06, 2021 Single taxpayers with a total income of $200,000 or less ($400,000 if married filing jointly) will be eligible for the child tax credit. Your number of qualifying children under age 17 multiplied by $2,000 will go into the first box. The number of other dependents multiplied by $500 will go in the second box. For more information on the proper use of exemption certificates in specific situations, see Rules 5703-9-03, 5703-9-10, 5703-9-14 and 5703-9-25 of the Ohio Administrative Code. General Exemption Certificate Forms. Unit Exemption Certificate. This exemption certificate is used to claim exemption or exception on a single purchase.

- Please note that Act 2015-504 does not impact the ability of military spouses to submit Form A4-MS, Nonresident Military Spouse Withholding Tax Exemption Certificate. Form A4-MS may continue to be accepted by employers for those employees who are claiming exemption from Alabama’s income tax withholding requirements based on the provisions of.

- IF YOU ARE SINGLE, $1,500 personal exemption is allowed. Wise, Alabama income (a) if you claim full personal exemption ($1,500) write a lefter 'S' tax must be withheld (b) if you claim no personal exemption write the figure 'O' (Note: If you claim no personal from your wages with-exemption on Lines 1 or 2, you cannot claim dependents on.

Introduction

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax. This bulletin explains:

- who may use exemption certificates,

- how to use them properly, and

- the various exemption certificates that are available.

Sales tax exemption certificates may also be issued and accepted electronically. For more information on e-certificates, see

TSB-M-07(1)S, Electronic Resale and Exemption Documents for Sales and Compensating Use Taxes.

When an exemption certificate is needed

A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable. This includes most tangible personal property and some services. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made, but preferably at the time of the sale.

Example: You purchase cleaning supplies, which are taxable, from a distributor. However, if you intend to resell the cleaning supplies to your customers (that is, you are purchasing the supplies for your inventory), you may purchase the supplies without paying sales tax.

Since the sale of cleaning supplies is normally subject to sales tax, the distributor needs some record to show why it didn’t collect sales tax from you. Otherwise, the distributor could be held liable for the tax. Therefore, if you give a properly completed exemption certificate to the distributor (in this case, Form ST-120, Resale Certificate) within 90 days of your purchase, you are certifying that you intend to resell the items you purchased.

If you intend to use the supplies yourself, you cannot use a resale exemption certificate, and the distributor must collect sales tax from you.

Certain sales are always exempt from tax. This means a purchaser does not need an exemption certificate to make purchases of these items or services. For a list of items and services that may be purchased tax-free without an exemption certificate, see Publication 750, A Guide to Sales Tax in New York State.

Who may use exemption certificates

You may use an exemption certificate if, as a purchaser:

- you intend to resell the property or service;

- you intend to use the property or service for a purpose that is exempt from sales tax; or

- you make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities.

In some cases, you must also have a valid Certificate of Authority to use an exemption certificate (see the chart at the end of this bulletin). Note that many exemption certificates are very specific about what type of purchaser may use the certificate; see the certificate’s instructions for details.

Most sellers must have a valid Certificate of Authority in order to accept an exemption certificate. A properly completed exemption certificate accepted in good faith protects the seller from liability for the sales tax not collected from the purchaser.

Exemption certificates of other states or countries are not valid to claim exemption from New York State and local sales and use tax.

How to use an exemption certificate

As a purchaser, you must use the correct exemption certificate, and complete it properly before giving it to the seller. The exemption certificate must include all the following:

- the date it was prepared;

- the purchaser’s name and address;

- the seller’s name and address;

- the identification number on the purchaser’s Certificate of Authority (some exemption certificates don’t require this, or may require another identifying number; see the certificate’s instructions);

- the purchaser’s signature, or an authorized representative’s signature; and

- any other information required by that particular certificate.

You must give the exemption certificate to the seller within 90 days after the date of the purchase. Otherwise, both you and the seller could be held liable for the sales tax.

Sellers have the right to refuse your exemption certificate, even if it is correct and properly completed. A seller that refuses your certificate must charge you sales tax. You may apply for a refund of the sales tax using Form AU-11, Application for Credit or Refund of Sales or Use Tax. For more information, see Tax Bulletins How to Apply for a Refund of Sales and Use Tax (TB-ST-350) and Sales Tax Credits (TB-ST-810).

For a list of general sales tax exemption certificates, see the chart at the end of this bulletin. Other certificates are listed in Tax Bulletin Quick Reference Guide for Taxable and Exempt Property and Services (TB-ST-740).

Blanket certificates

If you routinely make similar purchases from a seller, you may prefer to use a blanket certificate. This allows you to give your seller one exemption certificate to cover all similar purchases, rather than a separate certificate for each purchase. This option is available for many types of exemption certificates.

For example, suppose you are a wholesaler of plumbing supplies and you plan to make multiple purchases of copper tubing and fittings from a manufacturer and then resell those items to plumbing supply shops and hardware stores. Rather than give the manufacturer a separate exemption certificate each time you make a purchase, you may give the manufacturer one blanket certificate to cover all your similar purchases. When using an exemption certificate as a blanket certificate, mark an X in the blanket certificate box, rather than in the single purchase certificate box. If the certificate does not have these boxes, you may not use it as a blanket certificate.

If your address, identification number, or any other information on the blanket certificate changes, you must give your seller an updated blanket certificate. Your seller has the right to ask you for an updated blanket certificate at any time. Otherwise, the blanket certificate remains in effect as long as you are making exempt purchases from your seller.

Misuse of exemption certificates

If you willfully or knowingly issue a false or fraudulent exemption certificate, you may be subject to penalties, fines, or a jail sentence. For more information about these penalties, see Tax Bulletin Sales and Use Tax Penalties (TB-ST-805).

What a seller needs to know

As long as the purchaser gives you the appropriate certificate, properly completed, within 90 days of the date of the purchase, you do not have to charge the purchaser sales tax.

You must accept the certificate in good faith, which simply means that you had no prior knowledge that the certificate was false or fraudulent.

You must exercise ordinary care when accepting a certificate. You could be held liable for the sales tax you didn’t collect if you knew that the purchase was not for an exempt purpose, or you knew that the certificate was false or fraudulent.

You have the right to refuse to accept an exemption certificate, even if it is correct and properly completed. However, if you refuse a certificate, you must charge the purchaser sales tax.

A4 Single Tax Exemption

A4 Single Tax Exemption Requirements

You must attach the exemption certificate to the record of the purchase or have some other method of associating the exemption certificate with a particular sale. You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported. For more information, see Tax Bulletin Record-keeping Requirements for Sales Tax Vendors (TB ST-770).

General sales tax exemption certificates

Please note that this chart provides a brief description of the various exemption documents. Additional requirements may apply. See the individual forms and instructions for details.

| Exemption certificate (* may be used as blanket certificate) | Must purchaser have Certificate of Authority? | Purpose (see instructions on certificate for full details) | Notes |

|---|---|---|---|

| ST-120, Resale Certificate* | Yes, unless an out-of-state business | Property or services to be resold by the purchaser | Not for use by construction contractors |

| ST-120.1, Contractor Exempt Purchase Certificate | Yes | Certain property to be incorporated into real property and related services | For contractors to use instead of ST-120. See Publication 862 |

| ST-121, Exempt Use Certificate* | May be required depending on the exemption claimed | Property or services for exempt uses | Covers many exemptions |

| ST-121.1, Exemption Certificate for Tractors, Trailers, Semitrailers, or Omnibuses* | No | Qualifying vehicles and their parts, supplies, and services | |

| ST-121.2, Exemption Certificate for Purchases of Promotional Materials* | No | Promotional materials and associated services | |

| ST-121.3, Exemption Certificate for Computer System Hardware* | No | Computer system hardware for designing software | |

| ST-121.4, Textbook Exemption Certificate | No | Textbooks for college students | |

| ST-121.5, Exempt Use Certificate for Operators of Internet Data Centers* | No; ignore contrary instructions in 7/00 version of ST-121.5 | Certain property and services for an internet data center | |

| ST-121.9, Exempt Use Certificate for Certain Theatrical Productions* | No | Property for live dramatic or musical arts performances | Certain restrictions on blanket certificates |

| ST-124, Certificate of Capital Improvement | No | Capital improvement services purchased from construction contractors. See Publication 862 | Contractor need not have a Certificate of Authority to accept ST-124 |

| ST-125, Farmer's and Commercial Horse Boarding Operator's Exemption Certificate* | No for farmers; yes for commercial horse boarders | Property and certain services for farm production or commercial horse boarding | |

| ST-126, Exemption Certificate for the Purchase of a Racehorse | No | Certain registered thoroughbred or standardbred racehorses | |

| ST-860, Exemption Certificate for Purchases Relating to Guide, Hearing and Service Dogs* | No | Property or services for a registered service dog used by a person with a disability | |

| TP-385, Certification of Residential Use of Energy Purchases* | No | Certify residential property for energy use | Only if residential use is less than 75% |

| AU-297, Direct Payment Permit | Yes; also must have received AU-297 from Tax Department | Materials that may or may not be taxable when purchased | Purchaser gives photocopy of AU-297 to seller and remits tax directly to the Tax Department |

| ST-119.1, Exempt Organization Exempt Purchase Certificate | No, but must be an exempt organization for sales tax purposes | Purchases by organizations with an Exempt Organization Certificate | Available only by calling 1 (518) 485-2889 |

| ST-119.5, Exemption Certificate for Hotel or Motel Occupancy by Veterans Organizations | No, but must be a veterans organization or another authorized representative | Hotel rooms used by veterans organizations with an Exempt Organization Certificate | Must be issued with photocopy of the organization's Exempt Organization Certificate |

| ST-129, Exemption Certificate: Tax on Occupancy of Hotel Rooms | No, but must be a government employee of the United States or New York State | Hotel rooms used by New York State or federal government employees | May be accepted only by hotel operators. Does not provide exemption from locally administered occupancy taxes |

| DTF-801, Certificate of Indian Exemption for Certain Property or Services Delivered on a Reservation | No, but must meet the conditions listed on the form | For an enrolled member of one of the exempt nations or tribes listed on the form to make exempt purchases | In order to be exempt, the purchase must meet all of the conditions listed on the form |

| AC-946, Tax Exemption Certificate | No, but must be a New York State government employee (or employee of a political subdivision) | Property or services to be paid for by New York State or a political subdivision of the state | The employee must make the purchase while performing official duties |

| New York State governmental purchase order | No, but must be an agency, instrumentality, public corporation or political subdivision of New York State | Purchase of any taxable tangible personal property or service by a New York State governmental entity | Not a Tax Department form. A copy of a contract signed by an authorized New York government official is also sufficient to show exemption. Form ST-119.1 is not valid to show exemption for governmental entities |

| Federal purchase order | No, but must be an agency, or instrumentality of the United States | Purchase of any taxable tangible personal property or service by a United States governmental entity | Not a Tax Department form. A copy of a contract signed by an authorized United States government official is also sufficient to show exemption. Form ST-119.1 is not valid to show exemption for governmental entities |

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

A4 Single Tax Exemption Due Date

References and other useful information

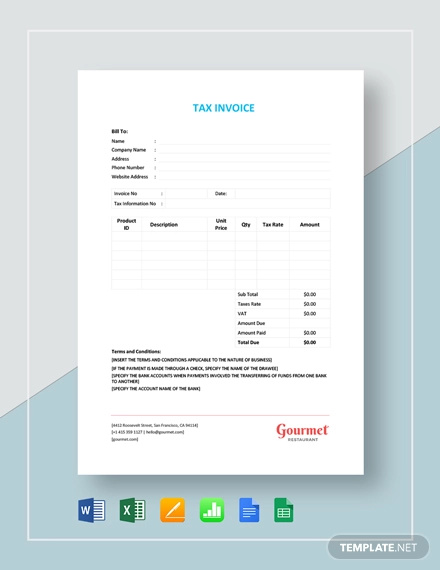

A4 Single Tax Exemption Forms

Tax Law: Section 1132(c)

Regulations: Sections 532.4; 532.5; and 533.2

Publications:

Publication 750, A Guide to Sales Tax in New York State

Publication 862, Sales and Use Tax Classifications of Capital Improvements and Repairs to Real Property

Memoranda:

TSB-M-07(01)S, Electronic Resale and Exemption Documents for Sales and Compensating Use Taxes

Tax Guidance Bulletins:

How to Apply for a Refund of Sales and Use Tax (TB-ST-350)

Quick Reference Guide for Taxable and Exempt Property and Services (TB-ST-740)

Record-Keeping Requirements for Sales Tax Vendors (TB-ST-770)

Sales Tax Credits (TB-ST-TB-ST-810)

Sales and Use Tax Penalties (TB-ST-805)